Hi everybody! Dana Sparks, Broker of Maximum One Greater Atlanta Realtors, here. Today's video is the beginning of a series on the 2019 Georgia Association of Realtors (GAR) contract forms. So, if you're watching this in December of 2018, please check out the link below. We are hosting a myriad of classes on the 2019 GAR contract form to keep you informed of the changes. These contract forms will be available starting January 1st, 2019. You can access them through FMLS and Georgia MLS. It's important to take our classes so you can be well-prepared to navigate the changes. We will be offering additional classes on the 2019 GAR forms in January and February as well. Now, let's dive into today's video. I'll start with an overview of the changes and then focus on the changes in the brokerage agreements. Overall, there aren't many significant changes, but the ones that have been made aim to clarify and improve understanding. This was an important aspect that had been addressed by GAR in the previous year as well. Here's where it gets interesting - every single form number has changed. So, for those of you who are used to referring to the forms by their form numbers (e.g. F20 - Purchase and Sale Agreement), you'll have to adjust to the new numbering system. However, if you go by the actual name of the form instead of the number, it's not a big deal. In fact, it's a positive change. GAR has organized all the forms into group numbers. This way, as GAR adds more forms, they can fit them into the designated topic category based on the number. For example, all the consumer brochures now have the designation "CB." Brokerage agreements are categorized in the 100s, so they will all start with a 100....

Award-winning PDF software

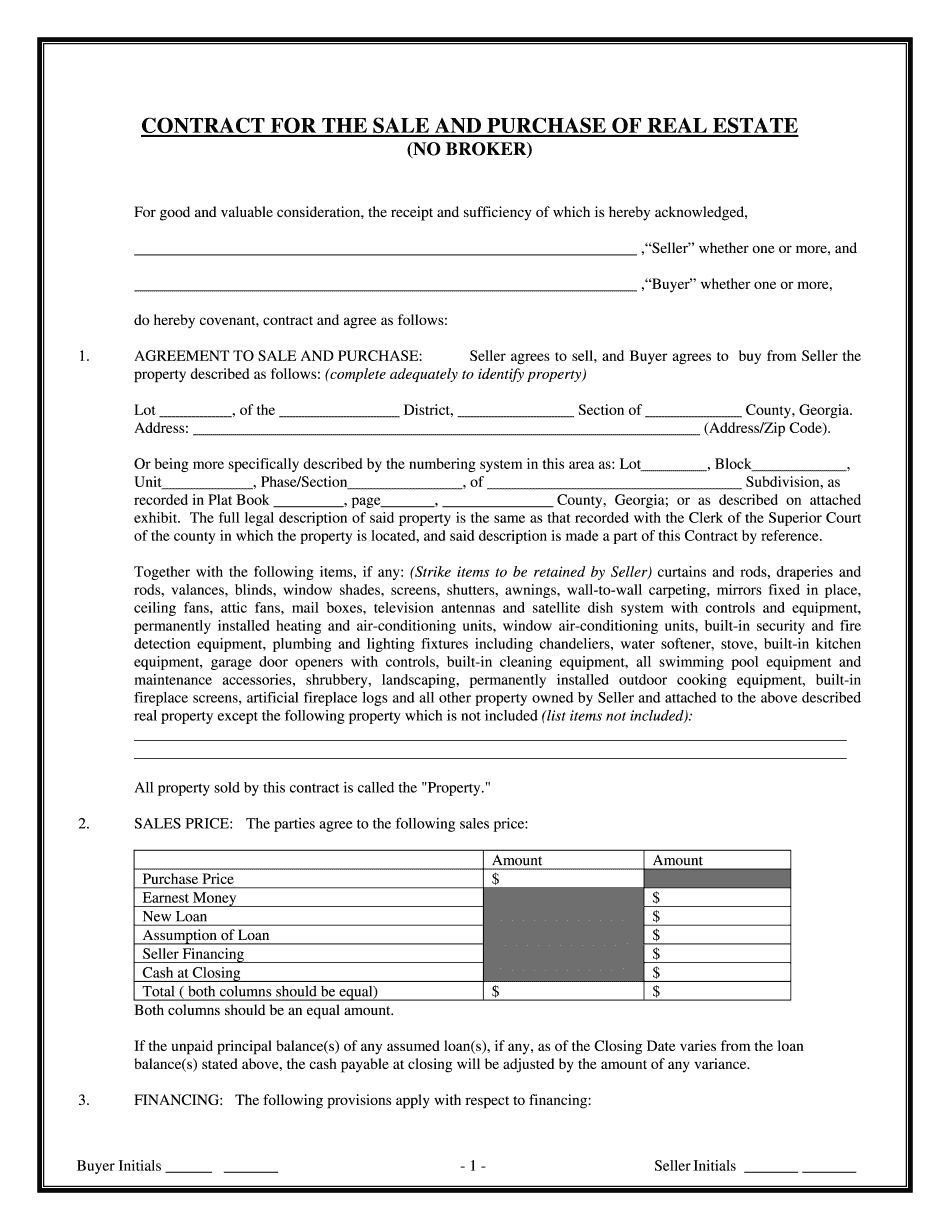

Georgia Real Estate Contract 2025 Form: What You Should Know

Property Tax (including county and municipal) at the prevailing rate, collected by the taxing authority, in the City of Savannah. (2) All taxes, fees, fees and assessments, if any, assessed or collected against the property by the City of Savannah, Georgia prior to the closing date. (3) All fees incurred prior to closing, including, without limitation, appraisal fees, broker's commission fees and other license fees and service fees, if applicable, fees for title insurance (which may include, without limitation, the issuance of foreclosure protection deeds) and any other fees for which the sale of the property is authorized by the City of Savannah, Georgia. Items Paid by Seller: At the closing, Seller shall pay: (1) Georgia Property Tax. (2) All taxes, fees, fees and assessments, if any, assessed or collected against the property by the City of Savannah, Georgia during and immediately following the sale of the property. At closing the Seller shall pay all fees and other obligations incurred prior to closing. The City of Savannah, Georgia shall furnish to Seller a deed of trust setting forth the terms and conditions of the sale, and the seller shall execute the deed of trust. The sale receipt shall be signed by the buyer and Seller and a deed of trust shall be executed as provided in this Agreement. If any item or items that are not a part of the purchase price is not paid at settlement, this Agreement shall be of no legal effect. Payment of any interest charge is expressly permitted unless the sale is to pay all or more than the total amount of taxes due on the property. Payment through bank wire transfer is permitted in connection with the transaction, provided that the bank wire transfer receipt shall be signed by the buyer and Seller and a deed of trust shall be executed by Buyer and Seller. Georgia Property Disclosure Statement — Property Taxes The Georgia Association of Residential Real Estate Brokers and Land Use Consultants, (“GAR”), a Georgia corporation and an association of individual real estate brokers and property owners in the State of Georgia, seeks to make the sale, as between the seller and buyer, of real property in the State of Georgia a simple, efficient, and hassle-free transaction. It is the buyer's job to make sure that the seller has complied with the applicable real property laws of Georgia. To that end, buyers must read, comprehend, and comply with the applicable Georgia Code. GAR conducts an annual review of the rules in the Real Property Law of Georgia.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Ga Contract of Sale & Purchase of Real Estate, steer clear of blunders along with furnish it in a timely manner:

How to complete any Ga Contract of Sale & Purchase of Real Estate online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Ga Contract of Sale & Purchase of Real Estate by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Ga Contract of Sale & Purchase of Real Estate from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Georgia Real Estate Contract 2025